LLC Setup

Form Your LLC With Ease

Setting up a business entity can be stressful and confusing. With Equity Specialty Services, you can trust we’ll make the process as quick and easy as possible. We have an experienced team that will work with you to navigate the many forms, filing requirements, and costs with ease.

Why do I need to set up a new LLC?

To ensure compliance with IRS rules and to maintain the tax-advantaged status of your IRA, you are required to form a NEW LLC for your Real Estate Checkbook IRA.

This LLC is created specifically to act as the investment vehicle through which your self-directed IRA can make investments and should be wholly owned by the IRA. You can’t use an existing LLC because mixing personal funds with IRA funds would be a prohibited transaction.

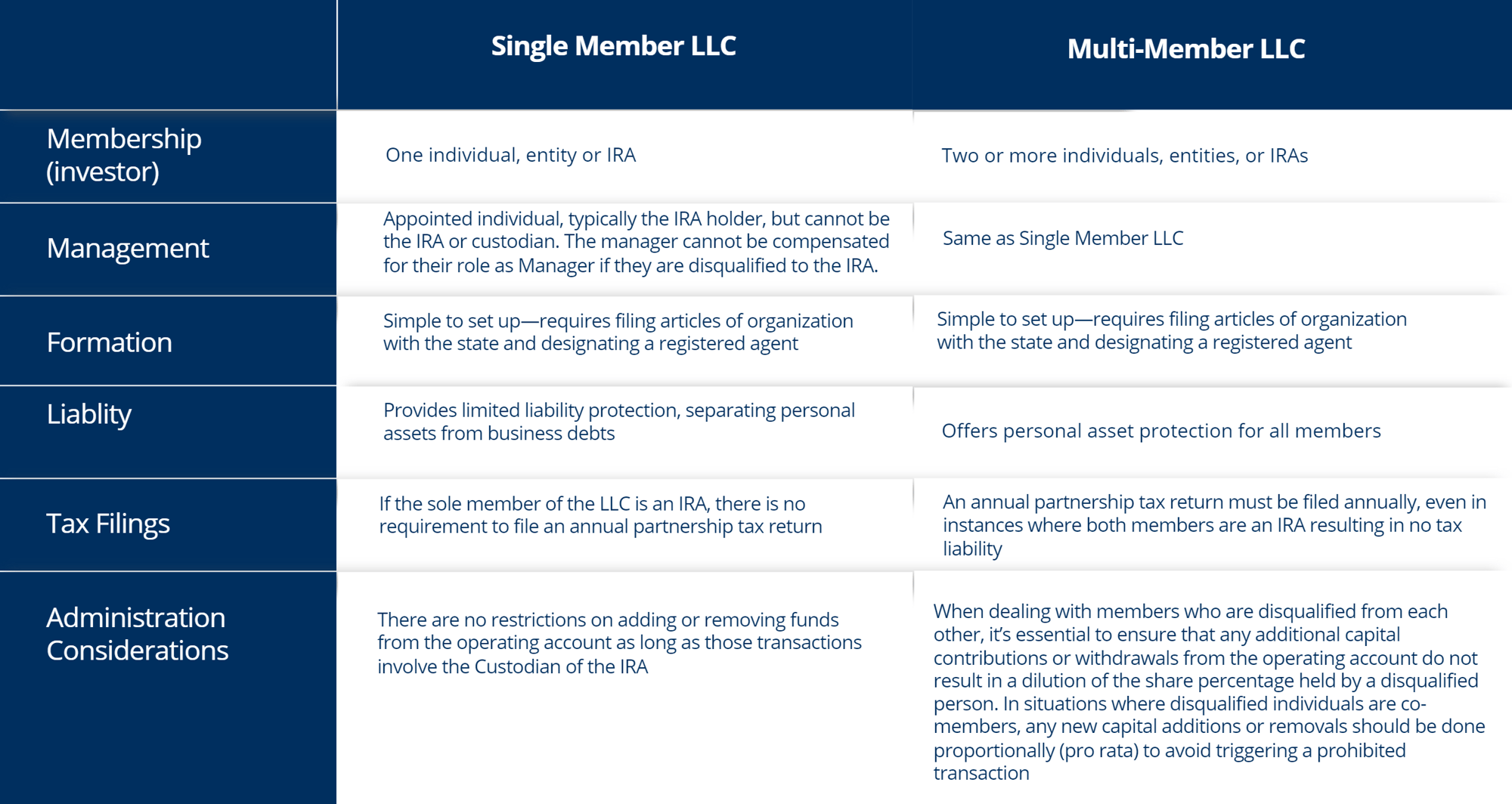

When using an LLC as an investment vehicle, it’s important to understand the differences between a single-member LLC and a multi-member LLC: